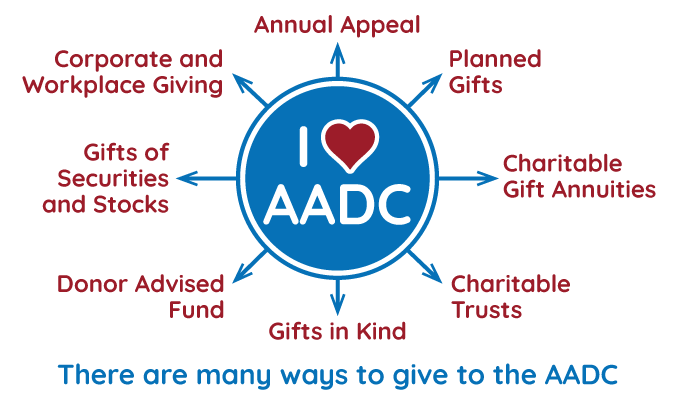

There are many ways you can support the AADC

We are ready to assist you in determining which means of funding a contribution may be right for you. Here are just some of the many ways to contribute:

Annual Appeal – the AADC Annual Appeal is our yearly fundraising effort, which runs throughout each fiscal year from July 1 to June 30. Today the AADC Annual Appeal offers a variety of community building opportunities and programs for alumnae and friends to demonstrate their philanthropy and pride for our association. Consistent throughout our history, however, is that the AADC is an alumnae-created, alumnae-led, alumnae-driven, and alumnae-supported organization. Make a Gift to the AADC today! Thank you.

Planned Gifts – you designate a bequest and other testamentary gift (i.e. via your life insurance policy) to the AADC to make a lasting impact on the future generations of alumnae and ensure the AADC’s Bright Future. Find more details in our Planned Giving Brochure.

Charitable Gift Annuities and Charitable Trusts – our development team can provide you with information about these donation vehicles.

IRA and Qualified Minimum Distributions – you can donate your Qualified Minimum Distributions from an IRA account once you turn 72. Contact our Development Team to learn more.

Gifts in Kind – are a wonderful way to support the AADC where you can donate property, artwork and other possessions. These kinds of gifts may provide you or your estate with tax benefits.

Donor Advised Fund – our staff will be happy to work with you about making gifts through a Donor Advised Fund.

Gifts of Securities and Stocks – are other options to give with impact. In addition, gifts made through wire transfers are also acceptable. We can provide the information needed to make these electronic transfers to the AADC.

Corporate and Workplace Giving – Become a Corporate Partner, make a Corporate Donation and workplace giving and matching funds.

Please contact our Development Team for more information at 732-246-1600, Ext. 14.